Introducing TRG Screen Contractual Rights Management Solutions 💡

(back to top)

We offer a portfolio of capabilities that addresses the needs of financial institutions throughout the CRM workflow. Using these services, clients today are able to extract and capture their usage rights, interpret them, socialize them within their organizations, and stay in compliance with them.

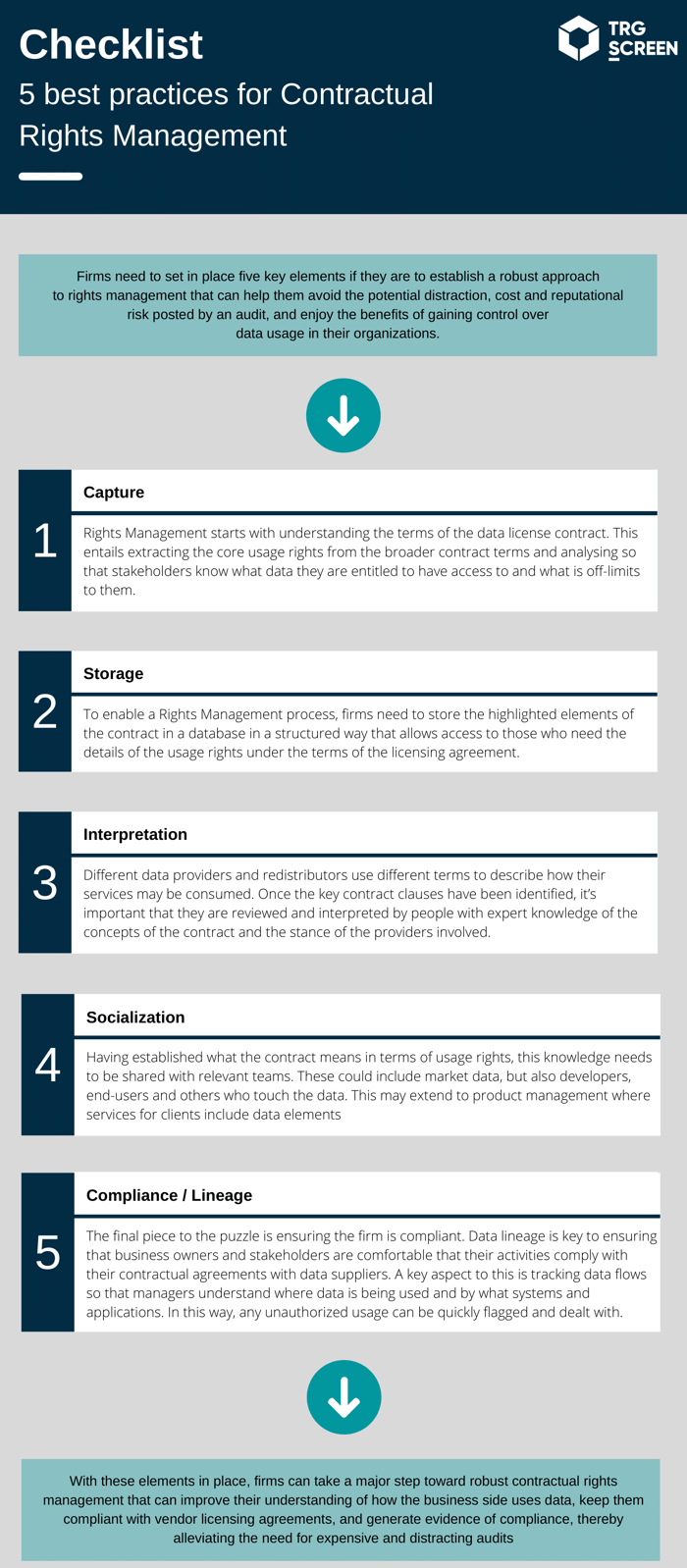

Capture ✅

Our PEAR product provides management of exchange agreements as a core offering, with many contracts downloadable from the portal.

PEAR offers capture and storage in a standardized and structured format, allowing clients to extract key contract clauses covering usage rights.

Our contract-parsing technology that uses advanced rules, artificial intelligence and machine learning to extract relevant contractual terms from PDF and Word documents.

Storage ✅

PEAR handles storage of contract details for exchange data, providing a single point of reference for usage rights for all exchange services, with a new module for non-exchange data in development. Meanwhile, a new Rights Management module for TRG Screen's Optimize Spend product has been released.

This first release – based on feedback from financial industry clients - includes a new repository to store contractual rights backed by a data dictionary of over 50 types of contractual terms.

Interpretation ✅

Our industry experts are available to help clients understand and interpret their contractual obligations and usage rights.

They have decades of experience in dealing with vendor licensing agreements and can advise on how to deal with the grey areas of contracts.

The importance of correct interpretation cannot be overstated: the socialization and data lineage tracking will not be effective if working to an incorrect assumption.

PEAR is a repository of exchange policy information and is ideally positioned for the interpretation aspect of Rights Management.

It can be used in combination with other TRG Screen components to ensure a standardized approach across the organization.

Socialization ✅

PEAR keeps track of exchange agreements and notifies application owners when terms change.

Our Application Compliance Tool (ACT) manages details of internal applications, surveys the application owners, and links applications to the exchange services they’re consuming.

The new Optimize Spend Rights Management also includes a portal providing users and developers with a catalogue of data with usage rights attached.

This will allow business users and developers to view the contractual usage terms for the services they subscribe to, or develop with.

Additional releases will add visibility of contractual rights during ordering and surveys/certification, integrating with ResearchMonitor, so that users are prompted with their usage rights and data sharing restrictions when they log into webbased market data and research services.

Compliance/Lineage ✅

ACT is a database for defining internal applications, based on surveys of application owners, with API linkage into PEAR.

It flags changes to exchanges’ market data usage rules in addition to highlighting licensing requirements and identifying any licensing gaps to ensure covered applications remain compliant.

ResearchMonitor tracks subscriptions to non-exchange services.

We also offer XPansion FTS’s Xmon, which provides monitoring of realtime and static data feeds, providing analysis of data flow and lineage, and flagging issues in real time.

Xmon is a comprehensive solution for monitoring the ingress of data feeds, such as Bloomberg Data License and Refinitiv DataScope, in to an organization and the flow, and lineage, of data as it’s shared between internal systems.

Using this portfolio of solutions, firms are able to introduce accountability into their contract compliance processes.

The approach ensures that data rights are clearly translated, displayed and accepted by the application owners.

What’s clear is that firms need to proactively manage their vendor relationships and gain control over access to the data services they subscribe to.

It’s no longer enough to be reactive and wait for a vendor or exchange audit; data managers need to be certain they have done enough to mitigate against the risk of non-compliance and a potentially expensive audit.

TRG Screen’s suite of Rights Management capabilities makes the company well positioned to address firms’ usage rights challenges, with products that address each stage of the Rights Management process and implementation path.