Client Success Story: ADS - Declaration Service

Industry Regulations 👨⚖️

Basel and MiFID: These regulations aim to strengthen investor protection, increase transparency around transaction reporting, ensure fairer, safer and more efficient markets, and unbundle products into pre and post trade products.

MiFID II contained over 1.4 million paragraphs and, while it is EU legislation, it has wider impacts beyond Europe.

Further reviews of MiFID II are set for 2021, and with the arrival of Brexit, it is even more likely that these reviews will be brought forward.

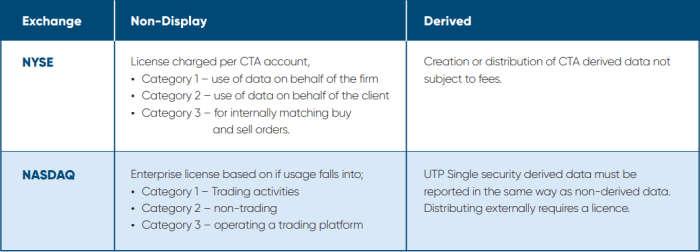

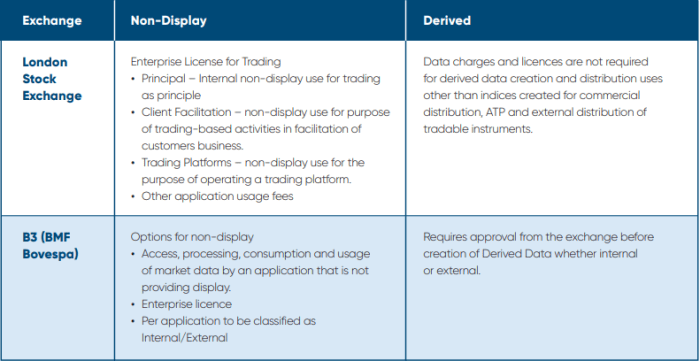

Due to MiFID II, the requirement that all trading venues must unbundle products into pre and post trade product has resulted in the introduction of additional data products and charges, in order to accommodate the unit of count policies around a natural person basis.

Generally, a higher data fee applies to user when adopting this unit of count.

As a result of this, 822 different fees across 512 products were introduced, across 14 exchange groups, whilst 1,003 licenses were also applied.

Athens Stock Exchange alone introduced 50 new products and 11 new licenses. The analysts managing ADS notify and help clients navigate the complexity around the licensing and product codes, in an efficient and timely manner.