Vendor compliance audits

Firms consume a broad range of services — such as market data, research, software & information services — in order to meet their complex business needs in today’s subscription economy. Enterprise subscriptions seem to be everywhere. Not surprisingly, the sources of data have come to realize this as well, and want to protect their intellectual property rights as well as their revenues.

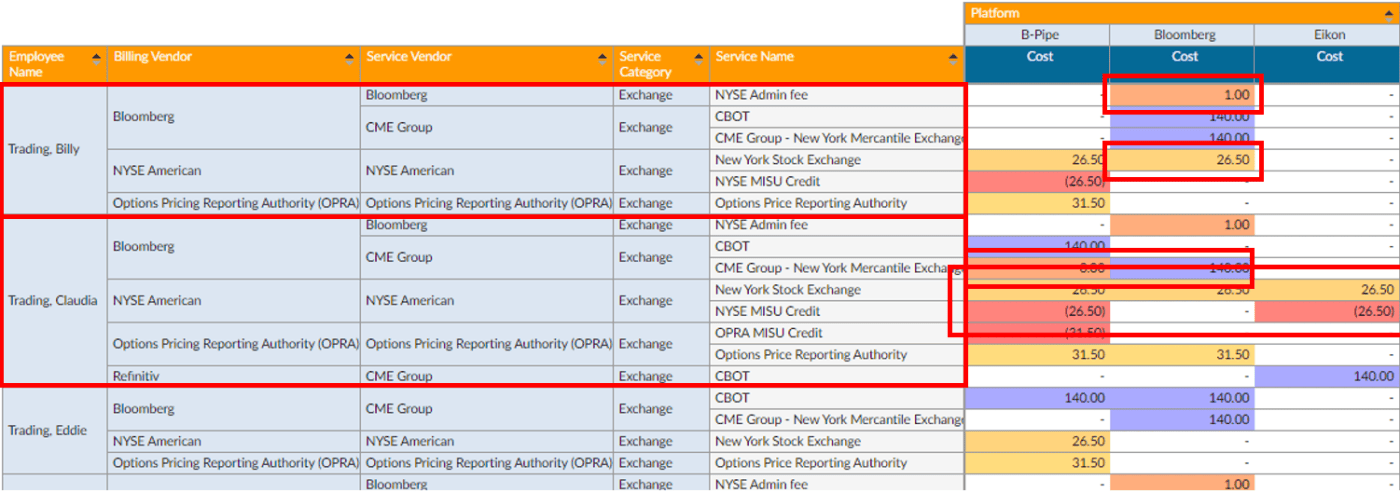

On the other hand, distribution, control, reporting of these enterprise subscriptions and their usage has become a real challenge for many organizations in a world where staffing levels in data management departments have only gone down. With the number of vendor compliance audits having increased dramatically in recent years — and substantial back bills as a result — many data & information managers realize it is time to act.