Survey Report - Market Data Management Challenges — Spend, Usage and Compliance

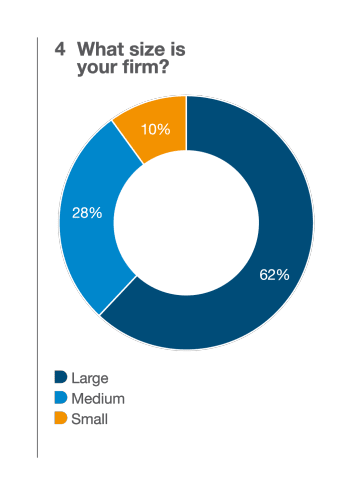

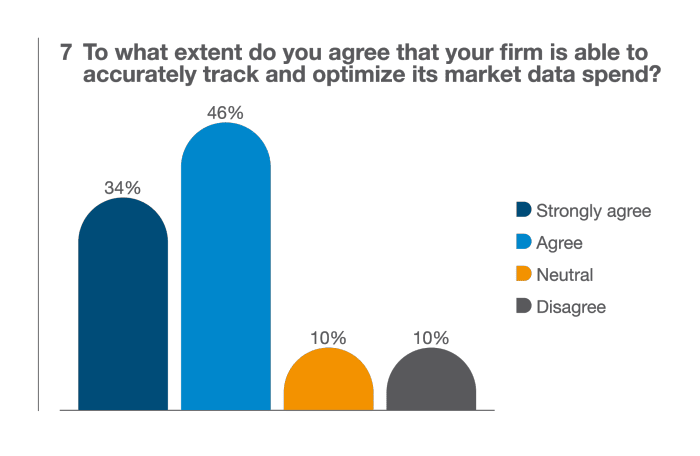

The ability for Capital Markets firms of all shapes and sizes to accurately and efficiently monitor their market data spend, usage and compliance might, at face value, seem like a simple undertaking - though, on closer scrutiny, it is anything but trivial.

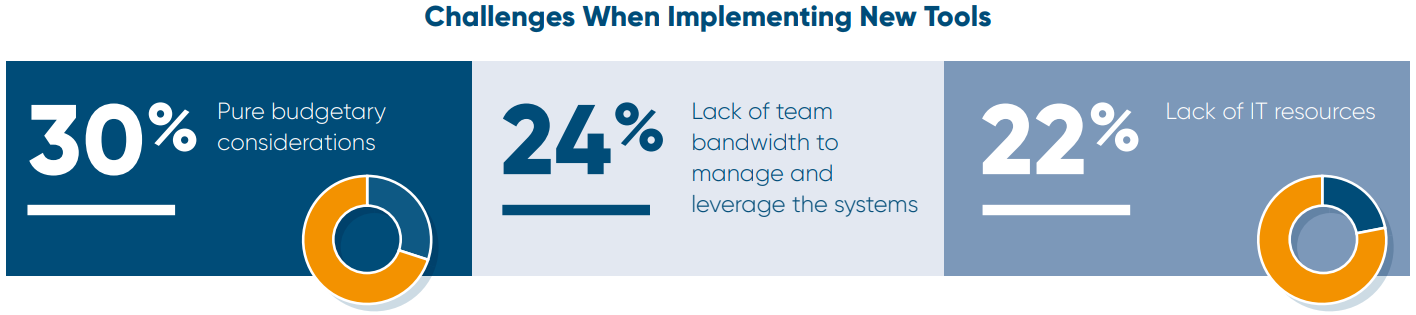

Not only is it a laborious and error-prone process - especially when managed manually - but it is also critical for firms to get the various processes falling under the market data umbrella absolutely right to minimize unnecessary spending and improve data sharing where appropriate across the business.

“The ability for capital markets firms to accurately and efficiently monitor their market data spend, usage and compliance is a perennial struggle for buy- and sell-side firms of all shapes and sizes.”

Needless to say, it’s a perennial struggle for buy- and sell-side firms, irrespective of size, sophistication, technological proficiency and technology/operational budgets.

In fact, this is one of the rare instances in the capital markets where, often, the larger the firm involved, the more acute the challenge becomes due to the sheer scale and variety of data it is consuming.

The number of departments, locations, individuals and use-cases it has invariably leads to data duplication where essentially different areas of the business are buying identical datasets and feeds. That said, this challenge by no means affects only the industry’s largest layers.

On the contrary, tier-two and tier-three firms with their relatively smaller technology budgets and headcounts face similar tribulations.

So what’s the answer? 💡

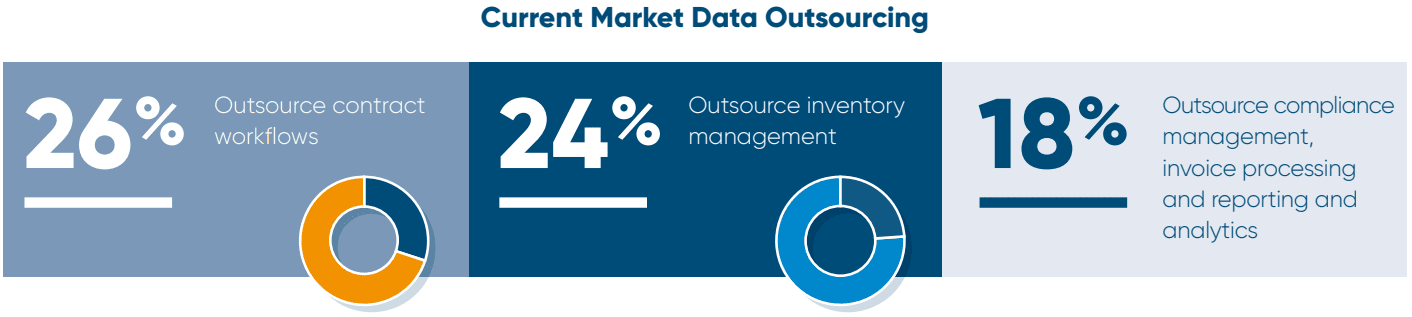

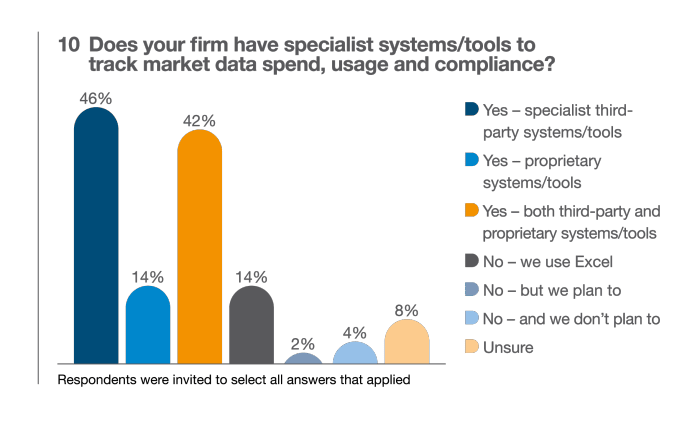

Some firms have resorted to spreadsheets and workarounds as a means of at least trying to get a handle on this aspect of their business.

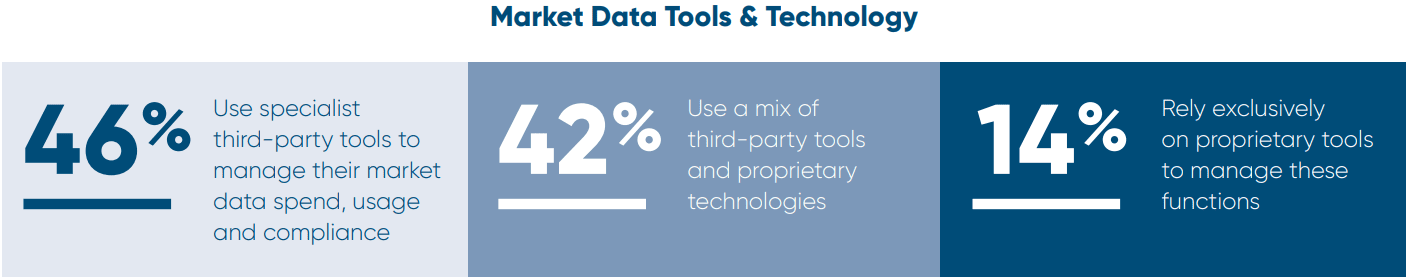

Others have developed proprietary applications or implemented generic contract management or procurement systems, although they invariably have their limitations in that they solve either the spend, usage or compliance aspects of the data management challenges — but not all three.