This article introduces our recent whitepaper “Market data spend hits another record as complexity grows”.

After rising every year for a decade, global spending hit a new peak of $44.3 billion in 2024 - a 6.4% increase in the previous year - according to an influential annual report from Burton-Taylor International Consulting. A separate report from the company shows the industry expects expenditure on market data to remain strong in 2024.

If ever there was a time for financial firms of all sizes to take control and optimize their market data spend and usage, it is now.

If ever there was a time for financial firms of all sizes to take control and optimize their market data spend and usage, it is now.

Market data consumers face a double-whammy: usage is being driven by greater acceptance of cloud technology and advances in firms’ ability to mine intelligence from data, Burton-Taylor says.

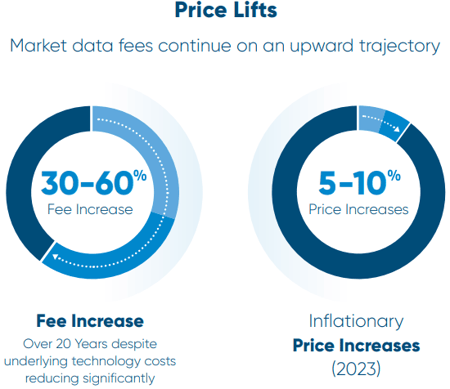

At the same time, users are paying more for data. Fees have risen by 30-60% in the past two decades, despite a significant fall in technology costs, and prices have gone up by 5-10% this year alone. No surprise, then, that market data is exceeded only by buildings and labor in the magnitude of financial firms’ costs.

It’s complicated

One driver of these costs is the growing complexity of the data itself. Firms are supplementing the traditional data sourced from stock exchanges and other vendors with new, alternative streams in a ceaseless struggle to get an edge over their competitors. That means new sources need to be evaluated, acquired and managed.

San Francisco-based Grand View Research valued the global alt data market at just shy of $4.5 billion in 2022, and analysts expect it to experience a compound annual growth rate of up to 55% between last year and 2030.

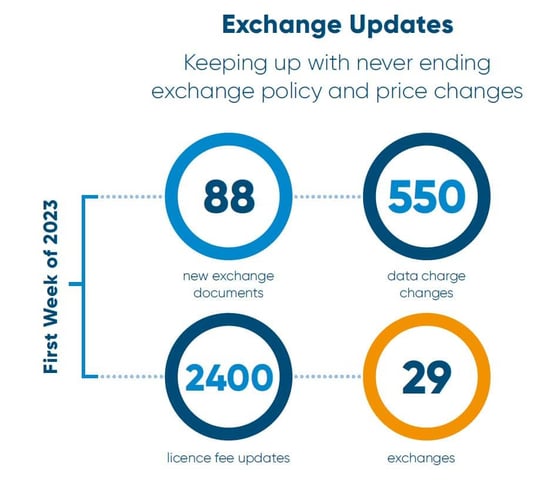

Even traditional data sources are becoming more complex and hard to keep up with. In just the first week of 2023, subscribers were hit with 88 new documents, 550 data charge changes and 2,400 license fee updates from 29 exchanges. No wonder leading experts say exchange policies change too quickly for anyone to follow without purpose-built technology.

(And, yes, there are still users out there who try to manage their market data with spreadsheets and generic procurement tools.)

Explosion of orders

In this environment, data teams face an explosion of user orders and requests as business requirements constantly change. Data licensing agreement, affected not least by hybrid working, are more complicated, as are invoices and payments. To cap it all, usage audits and declaration requirements have become more intense.

This is happening against a backdrop a scarcity of talent at a time when specialized market data expertise is at a premium.

Overall, there are some 3,000 data products from more than 500 suppliers to which firms can subscribe. That’s an awful lot to keep track of. That said, the benefits for those who are on top of their market data subscriptions are substantial.

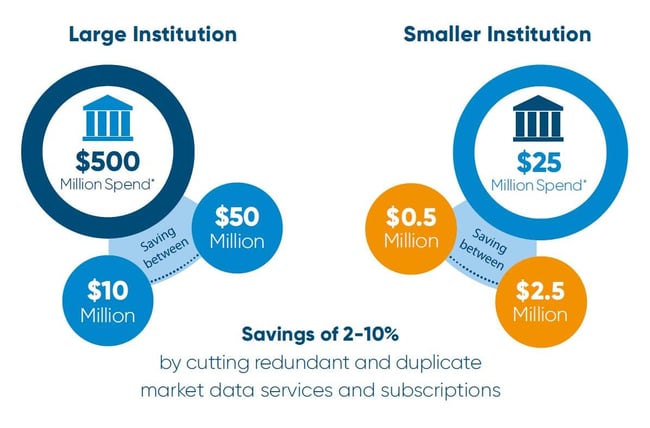

Industry insiders reckon large institutions spending $500 million on market data could save $10-50 million just by cutting redundant and duplicate data services and subscriptions. For smaller institutions spending $25 million, the savings could be between $500,000 and $2.5 million. That’s 2-10 percent in each case and not to be sniffed at. (Calculate your potential savings and ROI)

Imperative to optimize

These potential savings make it imperative that firms optimize both their spending on and use of market data.

For the data manager, the goal is total visibility of the firm’s data estate. That means clarity on spending, usage, compliance and data enquiries, among other factors. Together, this adds up to ensuring the right data gets to the right people – or apps – to meet the business’s needs.

Without this transparency, the team is effectively flying blind. Industry veterans shudder as they warn of the dangers of turning off the wrong data source.

But, it doesn’t have to be this way.

TRG Screen, with more than 20 years of experience, offers cutting edge solutions to manage data spend usage, compliance and enquiries – the entire lifecycle of market data subscriptions.

Flagship Optimize

Its flagship platform is Optimize, which does exactly what its name suggests.

Optimize Spend, launched in 2022, offered data managers unprecedented transparency on all aspects of spending. It catalogues sources used by individual users and automatically deals with compliance. Time-consuming contract renewals and invoices are dealt with.

The latest phase in TRG Screen’s multi-million-dollar investment in the platform is Optimize Insights. Unveiled in March, it represents a paradigm shift in market data management and reporting, offering users a high-level picture of their data landscape and the ability to drill down into the detail that data teams increasingly demand.

Optimize Insights unlocks data-driven intelligence and actionable insights do-this-now insights, delivered via BI-powered dashboards.

Seeking cost savings and efficiencies used to mean sifting through masses of management data. Monitoring compliance was laborious and error-prone. Optimize Insights supports the data team with automatic trend analysis that will explain why costs are changing.

Insights

Optimize Insights comes with Insights Library, a suite of visualizations and dashboards that tell a story or reveal key performance statistics. New ones will be added based on customer demand.

The insights need not be limited to market data; Optimize Insights supports analysis of other complex, high value enterprise subscriptions, including research, telecoms, IT and software.

Dashboard Studio, a drag-and-drop dashboard designer, allows users to create their own and interrogate the data as they wish.

Global spending on market data shows no sign of slowing down; neither does demand for this information that can rightly be called the lifeblood of financial trading and investment. Data teams will remain under pressure to keep a handle on this expanding universe.

However, Optimize Spend and Optimize Insights combined offer an unprecedent opportunity for firms to take control and optimize their market data subscriptions.

Want to learn more on how to optimize your market data spend?