Mundell is clear that insight comes only when data consumers can see the whole picture of their data landscape, from invoicing via exchange compliance to vendor due diligence, across the wider lifecycle of their market data subscriptions.

Some will try to do this the hard way, spending much precious time and effort on fundamentals but automatable tasks such as routing invoices or counting accesses to data feeds.

There is another way.

Adding value

“It’s about getting things done as efficiently as possible, making sure you’re adding as much value as possible to your business, not pushing buttons to drive a process that could be automated,” Mundell told the conference.

“It’s about money, right-sizing your subscriptions, negotiating the best deals, turning off the things you don’t need and staying in compliance with your contractual obligations and avoiding audits and penalties.”

It’s worth noting how much money is involved. Last year, the global spend on financial market data and analysis rose nearly 6 percent to $33.2 billion, according to Burton-Taylor Consulting. Mundell said a top-tier bank can spend $500 million a year on 500,000 subscriptions with 1,500 data vendors for 35,000 subscribers. A small firm will spend less but the cost per user is unlikely to be any less, he added.

Mundell told the conference that anyone managing market data subscriptions needs a data spend management system. “Otherwise, you're leaving 2 to 30% of cost savings on the table in the first year.”

Holy Grail

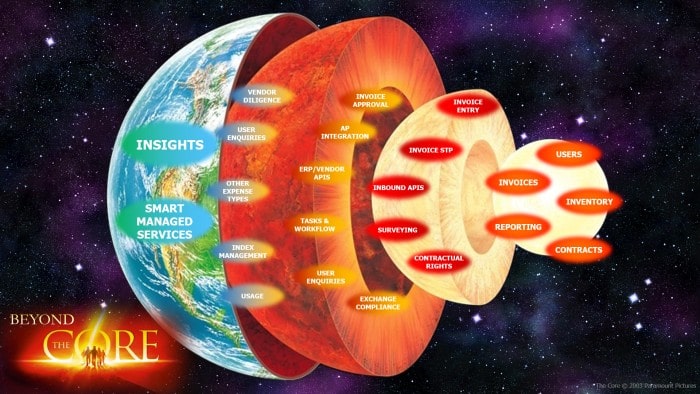

Think of the market data landscape as a cross-section of the Earth, divided into core-items including inventory, users and contracts - mantle and crust. (Click image to enlarge)

(Click image to enlarge)

Mundell’s first beyond-the-core function was invoicing. “There’s a lot of value you can add beyond basic invoicing functionality,” he said. Entering invoice details into the system was a time-consuming manual effort. “So the first thing to think about is a managed invoice reception service. Can you use a service provider to automatically process and upload your invoices into the system, leveraging invoice parsing technology and robotic process automation?”

The Holy Grail, he said, is invoice STP (straight-through processing) with APIs that automatically exchange data with other systems, including accounts payable. “You should be able to go through every step from receiving invoice approval to payment completely automatically with a human only taking manual action if there’s been a problem,” Mundell said.

APIs can interface with HR or workflow systems so data managers can keep track of leavers and joiners or a contract renewal. They can, in some cases, also “talk” to vendors’ systems. Another critical non-core function is the ability to survey users on, for example, what data they need or subscriptions they no longer use. That information was “absolutely crucial in negotiating really good pricing” with vendors, Mundell said, adding it could also ensure subscriptions were appropriate to users’ needs.

Contractual rights covering who can use data and how was an area often overlooked. Could data managers demonstrate compliance? Could users’ data requests fall foul of the rules? Mundell asked his virtual audience whether they were handling users’ data requests efficiently. Can users browse a data catalogue, check costs and automatically route requests?. The same was true of other requests, whether for information or reports. “You'll want to make sure you have a solution for managing and tracking all of the requests and inquiries coming into your team, so that everything gets handled properly, nothing slips through the cracks.”

Lifeblood

Consuming data from exchanges is the “lifeblood” of most financial firms but it comes with significant obligations – to ensure users pay the right amount and do not under-declare their subscriptions. Failure to do so can lead to audits and fines.

But how do data teams count their users? Which are professional or non-professional? What is a data feed being used for – algorithmic trading, to feed an app or to derive new data? All these use cases can require different licenses. “It’s a really important thing outside of the traditional core that you should be on top of if you're getting exchange data into your firm.” Mundell said.

By now, on our journey from the core of market data inventory management, we are leaving the mantle and heading for the crust, where some of the highest-value capabilities are to be found.

Index licensing, crucial for fund managers, needs to be tracked and catalogued, helping users choose the right index package. “Maybe you can rationalize some of your subscriptions if you have visibility over which indexes are available from which vendors in which packages,” Mundell said.

Market data teams are increasingly tasked with replicating how they manage data and usage with other types of spending on, for example, publications and expert network software. “Make sure you’re using tools that you can seamlessly extend into these areas and give a complete picture of your technology spend to your users,” Mundell said.

Challenge

As if that wasn’t enough, Mundell threw down another challenge to data managers. Had they done due diligence on their vendors and, if so, how often? “The last thing you want is a call from your vendor risk team blocking you from renewing an agreement or even trying to terminate an existing agreement because the due diligence certification has elapsed,” he said.

So much to think about and manage, but Mundell stressed companies should concentrate on their key purpose. For financial firms, it was providing financial products, not invoice reconciliation. The solution might be to use a “smart managed service” to perform these functions while benefiting from efficiencies of scale and automation.

How, then, can data managers meet all these challenges beyond the core? The answer is TRG Screen’s newly-launched Optimize platform.

At the apex of the platform will be Optimize Insights, due to be released early in 2022. It will provide cutting edge analytics, trend analysis and deliver actionable insights to a market data manager’s dashboard.

“If you're manipulating vast volumes of data in a spreadsheet, you really need to be moving to a paradigm where you're getting actionable insights, where you're having the greatest opportunities to optimize your costs presented to you,” Mundell said.

“We provide products and services which help you manage your whole lifecycle of market data from the core and beyond,” Mundell said. “This is all available as part of our brand-new optimize platform, providing all of these capabilities as a single best-of-breed solution.”

.png)